You Don’t Understand Compound Interest, let me explain.

Let’s talk about compound interest. Maybe you understand, maybe you don’t. I’m going to assume that you don’t, many people misuse the concept of exponential growth and that’s exactly what this is. It’s a critical concept in wealth accumulation, and we all want that, right?

Seriously, you need to internalize this one folks. Super super important stuff here.

Compound Interest, the core mechanism

At its essence, compound interest is more that interest on your money, or your initial investment. Compound interest is earning interest on your interest. Let’s define a few things.

- Principal: The initial investment.

- Interest: Earnings on your principal.

- Compounding period: The frequency at which your interest payment is calculated and added to the principal. This could be monthly, quarterly, or annually.

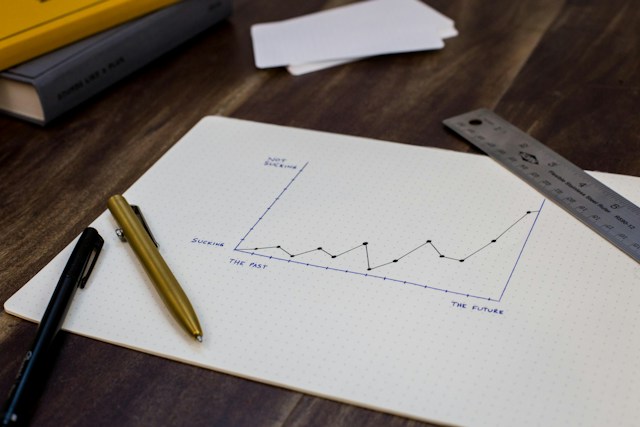

The really exciting part of compounding is it’s ability to generate a snowball effect (think snowball rolling down the hill and getting bigger and bigger, we want that for our money, right?) This mechanism of exponential growth, or compounding, can significantly create and grow your wealth over time. Time is your friend.

There’s a saying; “Time in the market beats timing the market.”

The power of time, start early for maximum impact

“Compound interest is the eighth wonder of the world. He who understands it, earnt it; he who doesn’t, pays it.” -Albert Einstein

Einstein understood the significance of time in the realm of compounding. The sooner you start investing, the more time you have to take advantage of exponential growth. Here’s an example:

Case Study: Jack vs. Jill

Jack starts investing $1000 annually at age 25, stops and age 35, total money invested is $10,000.

Jill starts investing $1000 annually starting at age 35 and keeps going until age 65. Total money invested is $30,000.

Assuming an 8% return and compounded monthly, when Jack is 65, he’ll have $160,701. Jill will have $119,708.

Jack has more money with less invested because of the longer time the money was allowed to compound. I encourage you to find an online compound interest calculator and play with it. The way this works is really exciting.

Another example, you may have heard is this; if you start with a penny and double that every day what will you have at the end of the month? Basically, this is compound interest with daily compounding and 100% interest rate. Wouldn’t that be nice. Play along because it illustrates the principle.

Day 1, I give you a penny.

Day 2, you get two pennies

Day 3, you get four pennies… and on

Day 30, you’ll have $5,368,709.12

Apply this knowledge. Practical ways to put compound interest to work.

- Start NOW: Regardless of your age, start. The sooner you begin the more time you have for compounding to work it’s magic. The best time to start is yesterday, the second best time is today. Don’t worry about missing the boat, just get going.

- Maintain Consistency: Think dollar cost averaging. Even if you don’t have a lot, investing a little at a time weekly or monthly, can really add up and give compounding the fuel it needs to work.

- Reinvest: Don’t withdraw your interest. Reinvest it and earn interest on your interest. Keep that going and you’ll see exciting results.

A great book on this topic is called, “The Automatic Millionaire.”

The exponential landscape

Compound interest is one of the most important tools in your financial toolbox. Exponential growth is an amazing tool that will allow most people, with careful budgeting, saving, and debt management, to achieve high levels of wealth. You could have millions of dollars someday.